- #COPY OF 2016 TAX EXTENSION VERIFICATION#

- #COPY OF 2016 TAX EXTENSION PASSWORD#

- #COPY OF 2016 TAX EXTENSION WINDOWS#

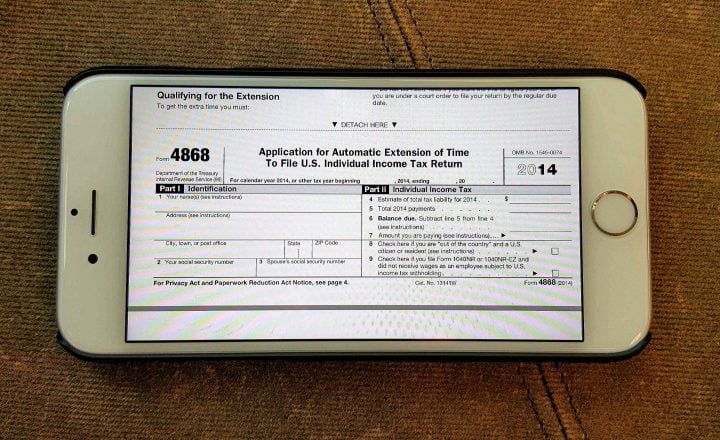

A hold will be placed on the following semester s aid until verification of the actual 2015 tax information has been submitted. Aid will be awarded based upon the Financial Aid Office s normal awarding schedule. The Financial Aid Office will review the information submitted and make any necessary corrections. Submit a signed copy of the 2014 federal tax return, including all Schedules, W2s and 1099s. Use the 2014 federal tax return as a guide to complete this form, replacing the figures with estimated 2015 figures. Submit the Verification of Estimated 2015 Taxable and Non-taxable income form. Submit either the Verification Worksheet/Dependent Student form or the Verification Worksheet/Independent Student form. Submit copies of all W-2s and 1099s for each source of income in 2015 for the student, spouse or parent filing an extension. Submit a copy of IRS Form 4868, Application of Automatic Extension of Time to File a U.S. Student must initial all three statements in the Agreement Section. It is best to submit all documents at the same time. Check each item (Required Information Section) being submitted with this form. Submit the Verification: Tax Filing Extension form. Tentative Award Process ETSU has implemented a Verification process to award aid tentatively based upon estimated income information. Instructions for tax filers filing an extension are detailed below. Even if the federal tax return has not been filed, income information must be verified. To verify income, students/parents (if dependent) must verify their income by submitting the IRS Tax Return Transcript obtained from the IRS or by correcting the FAFSA and utilizing the IRS Data Retrieval Tool to import tax information from the IRS into the FAFSA. Students will need to contact our office if they wish to use the Opt-Out Form. Verification can still be completed at a later date by student request. Students selected for Verification and who are only interested in receiving the Hope Scholarship ($4,000) can complete the Verification Opt- Out Form. As part of this process, students selected must verify income information before financial aid can be awarded. Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show.1 VERIFICATION - TAX FILING EXTENSION INSTRUCTIONS Approximately 30% of all FAFSA applications are randomly selected for the Verification process. To access your prior year tax returns sign onto the TurboTax website with the User ID you used to create the account.

Run the tool against any email addresses you may have used. Use this TurboTax account recovery website to get a list of all the User ID's for an email address. You have to sign onto your online account using the exact same User ID you used to create the online account. I have the email showing they were filed that way. See this TurboTax support FAQ for accessing prior year online tax returns - is nothing there. Click on the Year and Click on Download/print return (PDF) Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. To access your current or prior year tax returns sign onto the TurboTax website with the userID you used to create the account. TurboTax does not store online any returns completed using the desktop editions. If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. If none of the user ID's received will access your account, then use the option shown in blue on the account recovery website, " Try something else" Use this TurboTax account recovery website to get a list of all the user ID's for an email address. Copy and paste the account recovery website link onto a new web browser window and run the tool.

#COPY OF 2016 TAX EXTENSION WINDOWS#

You have to sign onto your online account using the exact same user ID you used to create the online account.Ĭlose all TurboTax windows on your web browser (including this one).

#COPY OF 2016 TAX EXTENSION PASSWORD#

If I cam remember what username and password and Sign in I Used

0 kommentar(er)

0 kommentar(er)